AI has generated headlines as well as improved computing capabilities in recent months. Since the arrival of generative artificial intelligence with the launch of ChatGPT in 2022, the new technology has taken the tech world and the wider economy by storm. The impact of AI has been felt in everything from supercomputers and semiconductor chip manufacturing to graphic design and language translations.

This is opening up new opportunities for investors, and a look at some numbers will show just how vast these opportunities are. According to market analysis company Grand View Research, the AI market could reach $1.8 trillion by 2030, a far cry from its $137 billion value in 2022. Meanwhile, investment firm Wedbush predicts that AI spending will account for between 8% and 10% of IT Budgets by the end of this year.

No investor can ignore a sector that pours as much cash as this one, and AI stocks are reaping the benefits of increased investor interest.

Against this backdrop, leading analysts from Argus have identified Nvidia (NASDAQ:NVDA) and Palantir (NASDAQ:PLTR) as the top investment opportunities in the AI sector. Are these views widely shared? We turn to the TipRanks database for insights. Let’s dig deeper.

Nvidia

We’ll start with Nvidia, the semiconductor chipmaker whose meteoric rise in share price has reflected its strength in the market for AI-capable processor chips. Artificial intelligence systems depend heavily on graphics processor units, high-capacity semiconductor chips capable of supporting the extensive and fast computing functions that AI requires. Nvidia was the original developer of these chips, which were originally used to support the demand for high-end graphics from PC gamers. Against this backdrop, Nvidia shares have surged an impressive 194% over the past 12 months.

Nvidia’s steep rise in stock price has also pushed the company into the top tier of the public markets. Nvidia currently boasts a market cap of nearly $3.25 trillion, making it one of only three $3 trillion firms.

In the first week of June, Nvidia stock was trading well above $1,100 per share, prompting the company to approve a 10-for-1 stock split that became effective on June 7. The split effectively lowered the share price, which now sits above $120.

Nvidia reported its fiscal 1Q25 results last month and beat forecasts across the board. The company’s top line, $26 billion, grew 262% year-over-year and was $1.45 billion better than estimates. Ultimately, Nvidia had non-GAAP EPS of $6.12, 54 cents per share better than forecast. The company’s overall success was enabled by record results in the Data Center segment; This business segment brought in $22.6 billion in total revenue, for a 427% year-over-year gain.

For Argus’ Jim Kelleher, a 5-star analyst rated in the Street’s top 1% of stocks, the key here is Nvidia’s recent track record of success and its potential to continue delivering that success going forward.

“Following a very successful FY24, Nvidia is, in our view, positioned for continued momentum in FY25. NVDA stock has a long way to go, given the company’s positioning within transformative AI technology. We recommend creating or adding positions to this outstanding tool for participating in the AI economy. We believe most technology investors should own NVDA in the era of deep learning, AI and GPU-driven application acceleration,” said Kelleher.

The lead analyst continues to set a Buy rating on NVDA stock, with a $150 price target implying room for a one-year upside of 18.5%. (To see Kelleher’s record, click here)

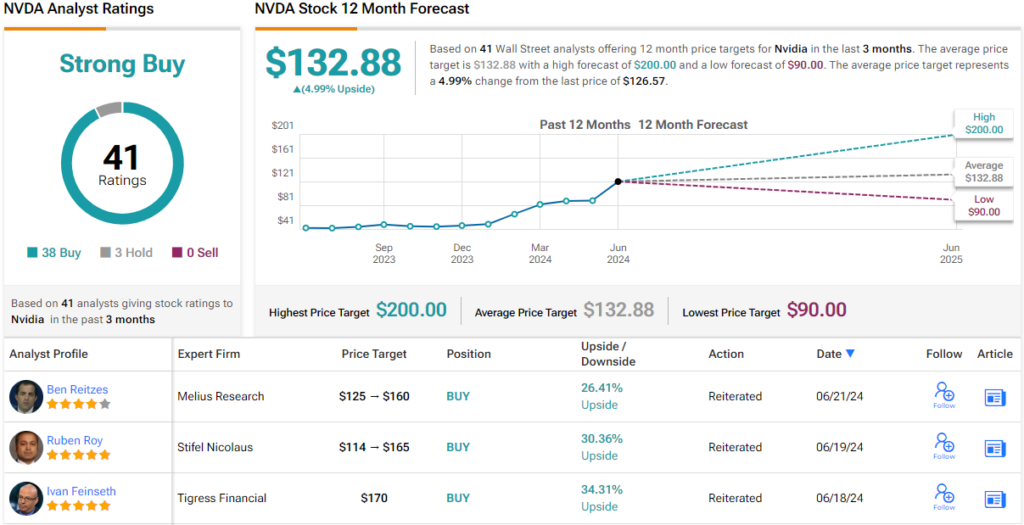

Overall, NVDA has received no fewer than 40 recent analyst reviews, and the lopsided 37-to-3 split favoring buys over holds gives the stock its consensus rating of Strong Buy. However, the average price target stands at $132.88, suggesting a modest 5% upside from current levels. (See NVDA stock forecast)

Palantir Technologies

The second stock we’ll look at is Palantir Technologies, one of the leading data analytics companies in the tech world. The company, which started as a creation of the well-known billionaire Peter Thiel, has been operating for 21 years. Palantir’s founding goal was to combine the best of data analytics with human intuition, to reap the benefits of both. This mission was tailor-made for AI, and Palantir uses AI to power its data-driven applications.

In fact, AI lies at the heart of Palantir’s work and activities these days. The company uses AI to augment the intelligence of human operators, offering a variety of applications and data analysis platforms to its customers. Palantir’s flagship AI platform, AIP, allows users to interface with the system using natural language – no need for purpose-written computer scripts or complex coding languages. AI can return results using ordinary language, providing nuanced answers to user questions, with high levels of detail and data analysis accessible to the layman.

Like Nvidia, Palantir has benefited greatly from the recent rapid expansion of AI technology, particularly generative AI capable of imitating human expression. Some recent announcements from the company underline this fact.

In late May, Palantir announced it had been selected for a Defense Department contract worth $153 million initially, with additional awards of up to $480 million possible over the next five years. The contract is intended as a step toward integrating AI technology into DOD’s ability to make better and faster decisions.

The Defense Department contract was followed in June by a major civilian contract, an agreement with Tampa General Hospital to provide basic analytics and an AI platform. The goal is to use AI to power workflow coordination for greater efficiency and improved resource allocation.

Given all of this, it should come as no surprise that Palantir’s top and bottom lines have been trending upward in recent quarters. The company reported 8 cents per share in non-GAAP earnings for 1-24, in line with forecasts and significantly higher than the 5-cent EPS reported in the year-ago period. At the top, the company’s revenue of $634 million rose more than 20% year-over-year — and was $16.72 million better than estimates. In a metric that bodes well going forward, Palantir reported a 42% year-over-year increase in its customer base during the first quarter.

Joseph Bonner, a 5-star analyst at Argus, is bullish on Palantir, citing its strong commercial prospects as a key driver of future growth.

“While Palantir has long served the needs of the US defense and intelligence community, the company has expanded into the commercial sector with data management and analytics platforms capable of providing solutions to complex business problems. The company’s government business generated 55% of revenue in 2023. While we expect this segment to continue to grow, the commercial business, particularly in the US, appears to be the driver of its future growth. Like many enterprise software companies we cover, Palantir relies on new AI-powered applications to expand its business,” Bonner explained.

Bonner’s Buy rating on PLTR stock is complemented by a $29 price target that implies a one-year upside potential of ~22%. (To see Bonner’s record, click here)

While Bonner’s outlook is bullish, the broader consensus among analysts leans toward a Hold (ie Neutral) rating based on 6 Hold, 4 Sell and 4 Buy recommendations. The average price target currently stands at $22.55, indicating a potential downside of ~5% from the current share price of $23.84. (See PLTR stock forecast)

To find good ideas for trading stocks with attractive valuations, visit TipRanks Best Stocks to Buy, a tool that brings together all of TipRanks equity knowledge.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your due diligence before making any investment.